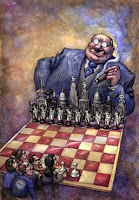

This Is What It Feels Like To Have Your Life Savings Confiscated By The Global Elite

Michael Snyder

Activist PostWhat would you do if you woke up one day and discovered that the

banksters had "legally" stolen about 80 percent of your life savings?

Most people seem to assume that most of the depositors that are getting

ripped off in Cyprus are "Russian oligarchs" or "wealthy European

tycoons", but the truth is that they are only just part of the story.

As you will see below, there are small businesses and aging retirees

who have been absolutely devastated by the wealth confiscation that has

taken place

in Cyprus.

Many businesses can no longer meet their payrolls or pay their bills

because their funds have been frozen, and many retirees have seen

retirement plans that they have been working toward for decades

absolutely destroyed in a matter of days.

Sometimes it can be hard to identify with events that are happening on

the other side of the globe, but I want you to try to put yourself into

their shoes for a few minutes. How would you feel if something like

this happened to you?

For example, just consider the case of one

65-year-old retiree that has had his life savings totally wiped out by

the "wealth tax" in Cyprus.

His very sad story was recently featured by

the Sydney Morning Herald...

<blockquote>''Very bad, very, very bad,'' says 65-year-old John

Demetriou, rubbing tears from his lined face with thick fingers. ''I

lost all my money.'' </blockquote><blockquote>John now lives in the

picturesque fishing village of Liopetri on Cyprus' south coast. But for

35 years he lived at Bondi Junction and worked days, nights and

weekends in Sydney markets selling jewellery and imitation jewellery. </blockquote><blockquote>He

had left Cyprus in the early 1970s at the height of its war with

Turkey, taking his wife and young children to safety in Australia. He

built a life from nothing and, gradually, a substantial nest egg. He

retired to Cyprus in 2007 with about $1 million, his life savings. </blockquote><blockquote>He

planned to spend it on his grandchildren - some of whom live in Cyprus

- putting them through university and setting them up. There would be

medical bills; he has a heart condition. The interest was paying for a

comfortable retirement, and trips back to Australia. He also toyed with

the idea of buying a boat. </blockquote><blockquote>He wanted to leave

any big purchases a few years, to be sure this was where he would spend

his retirement. There was no hurry. But now it is all gone. </blockquote><blockquote>''If I made the decision to stay, I was going to build a house,'' John says. ''Unfortunately I didn't make the decision yet. </blockquote><blockquote>''I went to sleep Friday as a rich man. I woke up a poor man.''</blockquote>You can read the rest of the article

right here.

How would you feel if you suddenly lost almost everything that you have been working for your entire life?

And many small and mid-size businesses have been ruined by the bank account confiscation that has taken place in Cyprus.

The following is a bank account statement that was originally posted

on a Bitcoin forum that has gone absolutely viral all over the Internet. One medium size

IT business has lost a staggering amount of money because of the

"bail-in" that is happening in Cyprus...

The following is what the poster of this screenshot

had to say about what this is going to do to his business...

<blockquote>Over 700k of expropriated money will be used to repay

country's debt. Probably we will get back about 20% of this amount in

6-7 years. </blockquote><blockquote>I'm not Russian oligarch, but just

European medium size IT business. Thousands of other companies around

Cyprus have the same situation. </blockquote><blockquote>The business is definitely ruined, all Cypriot workers to be fired. </blockquote><blockquote>We

are moving to small Caribbean country where authorities have more

respect to people's assets. Also we are thinking about using Bitcoin to

pay wages and for payments between our partners. </blockquote><blockquote>Special thanks to: </blockquote><blockquote>- Jeroen Dijsselbloem </blockquote><blockquote>- Angela Merkel </blockquote><blockquote>- Manuel Barroso </blockquote><blockquote>- the rest of officials of "European Commission"</blockquote>With each passing day, things

just continue to get worse for those with deposits of over 100,000 euros in Cyprus. A few hours ago, a Reuters story entitled "

Big depositors in Cyprus to lose far more than feared" declared that the initial estimates of the losses by big depositors in Cyprus were much too low.

And of course the truth is that those that have had their deposits

frozen will be very fortunate to see any of that money ever again.

But just a few weeks ago, the Central Bank of Cyprus was swearing that

nothing like this could ever possibly happen. Just check out the

following memo from the Central Bank of Cyprus dated "11 February 2013"

that was recently posted on

Zero Hedge...

Sadly, the truth is that the politicians will lie to you all the way up until the very day that they

confiscate your money.

You can believe our "leaders" when they swear that nothing like this

will ever happen in the United States, in Canada or in other European

nations if you want.

But I don't believe them.

In fact, as an outstanding article

by Ellen Brown recently detailed, the concept of a "bail-in" for "systemically

important financial institutions" has been in the works for a long

time...

<blockquote>Confiscating the customer deposits in Cyprus banks, it

seems, was not a one-off, desperate idea of a few Eurozone “troika”

officials scrambling to salvage their balance sheets. A joint paper by

the US Federal Deposit Insurance Corporation and the Bank of England

dated December 10, 2012, shows that these plans have been long in the

making; that they originated with the G20 Financial Stability Board in

Basel, Switzerland (discussed earlier

here); and that the result will be to deliver clear title to the banks of depositor funds.</blockquote>If

you do not believe that what just happened in Cyprus could happen in

the United States, you need to read the rest of her article. The

following is an extended excerpt

from that article...

*****

Although

few depositors realize it, legally the bank owns the depositor’s funds

as soon as they are put in the bank. Our money becomes the bank’s, and

we become unsecured creditors holding IOUs or promises to pay. (See

here and

here.)

But until now the bank has been obligated to pay the money back on

demand in the form of cash. Under the FDIC-BOE plan, our IOUs will be

converted into “bank equity.” The bank will get the money and we will

get stock in the bank. With any luck we may be able to sell the stock to

someone else, but when and at what price? Most people keep a deposit

account so they can have ready cash to pay the bills.

The 15-page FDIC-BOE document is called “

Resolving Globally Active, Systemically Important, Financial Institutions.”

It begins by explaining that the 2008 banking crisis has made it

clear that some other way besides taxpayer bailouts is needed to

maintain “financial stability.” Evidently anticipating that the next

financial collapse will be on a grander scale than either the taxpayers

or Congress is willing to underwrite, the authors state:

<blockquote>An efficient path for returning the sound operations of the

G-SIFI to the private sector would be provided by exchanging or

converting a sufficient amount of the unsecured debt from the original

creditors of the failed company [meaning the depositors] into equity [or

stock]. In the U.S

., the new equity would become capital in one or more newly formed operating entities. In the U.K., the same approach could be used, or

the equity could be used to recapitalize the failing financial company itself—thus, the highest layer of surviving bailed-in creditors would become the owners of the resolved firm. In either country

, the new equity holders would take on the corresponding risk of being shareholders in a financial institution.</blockquote>No

exception is indicated for “insured deposits” in the U.S., meaning

those under $250,000, the deposits we thought were protected by FDIC

insurance. This can hardly be an oversight, since it is the FDIC that is

issuing the directive. The FDIC is an insurance company funded by

premiums paid by private banks. The directive is called a “resolution

process,”

defined elsewhere as a plan that “would be triggered

in the event of the failure of an insurer . . . .” The only mention of “insured deposits” is in connection with

existing UK legislation, which the FDIC-BOE directive goes on to say

is inadequate, implying that it needs to be modified or overridden.

*****

You can find the rest of her excellent article

right here. I would encourage everyone to especially pay attention to what she has to say about derivatives.

Sadly, what is happening in Cyprus right now is just the continuation

of a trend. In recent years, governments all over the world have

turned to the confiscation of private wealth in order to solve their

financial problems. The following examples are from a recent article

posted

on Deviant Investor...

<blockquote>

October 2008 – Argentina’s leftist government,

facing a gigantic revenue shortfall, proposes to nationalize all

private pensions so as to meet national debt payments and avoid its

second default in the decade. </blockquote><blockquote>

November 2010 – Headline – Hungary Gives Its Citizens an Ultimatum: Move Your

Private Pension Fund Assets to the State or Permanently Lose Your

Pension – This is an effective nationalization of all pensions. </blockquote><blockquote>

November 2010 – Ireland elects to appropriate ten billion euros from its National

Pension Reserve Fund to help fund an eighty-five billion euro rescue

package for its besieged banks. Ireland also moves to consider a

regulatory move that compels some private Irish pension funds to hold

more Irish government debt, thereby providing the state with a captive

investor base but hugely raising the risk for savers. </blockquote><blockquote>

December 2010 – France agrees to transfer twenty billion euros worth of assets

belonging to its Fonds de Reserve pour les Retraites (FRR), the funded

portion of its retirement system, to help pay off recurring social

benefits costs. No pensioners are consulted. </blockquote><blockquote>

April 2012 – Argentina announces that its Economy Ministry has taken an emergency

loan from the national pension fund in the amount of $4.3 billion. No

pensioners were consulted. </blockquote><blockquote>

June 2012 –

Treasury Secretary Timothy Geithner unilaterally appropriates $45

billion from US federal pension funds to help tide over US deficits for

the remainder of fiscal year 2011. </blockquote><blockquote>

January 2013 – Treasury Secretary Geithner again announces that the government has

begun borrowing from the federal employees pension fund to keep

operating without passing the approaching “fiscal cliff” debt limit.

The move effectively creates $156 billion in borrowing authority from

federal pension funds. </blockquote><blockquote>

March 2013 – Open

Bank Resolution finance minister, Bill English, is proposing a Cyprus

style solution for potential New Zealand bank failures. The reserve

bank is in the final stages of establishing a rescue scheme which will

put all bank depositors on the hook for bailing out their banks.

Depositors will overnight have their savings shaved by the amount

needed to keep distressed banks afloat.</blockquote>

Can you see the pattern?

As I wrote about

the other day,

no bank account, no pension fund, no retirement account and no stock

portfolio will be able to be considered 100% safe ever again.

And once the

global derivatives casino melts down, there are going to be a lot of major banks that are going to need to be "bailed in".

When that day arrives, they are going to try to come after

your money.

So don't leave your entire life savings sitting in a single bank -

especially not one of the banks that has a tremendous amount of exposure

to

derivatives.

Hopefully we can get more people to wake up and realize what is

happening. We are moving into a time of great financial instability,

and what worked in the past is not going to work in the future.

Be smart and get prepared while you still can.

Time is running out.

Source:-

http://www.activistpost.com/2013/03/this-is-what-it-feels-like-to-have-your.html